Top 10 figures influencing the stock market

Editor's notes:

China's massive stimulus package and fiscal policies stimulated the economic recovery in 2009. They also pushed the stock market up with the Shanghai Composite Index increasing from less than 2,000 to over 3,000. Here are the top 10 people influencing the stock market, selected by Chengdu Evening News. It may help investors better understand the market.

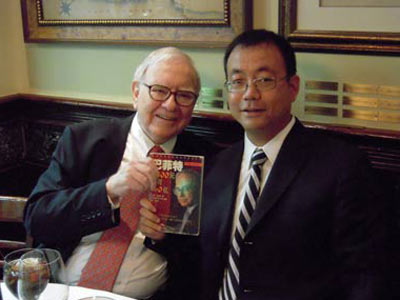

1. Zhao Danyang: Godfather of privately offered fund

Zhao Danyang, a Hong Kong hedge fund manager, had lunch with billionaire investor Warren Buffett on June 24. Zhao, who runs Hong Kong-based Pureheart China Growth Investment Fund, paid $2.11 million to win the opportunity in a charity auction on eBay.

During lunch, Zhao handed him the annual reports of Wumart Stores Inc, Beijing's largest supermarket chain and made recommendations about this Hong Kong-listed share.

In the next four days, Wumart stock jumped almost 24 percent, which meant Zhao, who held 65.95 million shares of Wumart by the end of March, earned approximately HK$130 million ($16.76 million) in less than a week.

Later Zhao began to sell his shares and raked in about HK$500 million by mid-December.

Related:

2. Liu Yiqian: King of additional shares

Liu Yiqian and his company spent 1.68 billion yuan ($246.06 million) buying 700 million additional shares of BOE Technology Group Co in June, according to BOE's announcement.

Later, Liu purchased additional shares issued by Poly Real Estate, Beijing Capital Development Co, Gemdale Corporation, Shanghai Pudong Development Bank Co, China Sports Group Industry Co, Huadian Power International Corporation and Dongfang Electric Corporation.

Every purchase exceeded 300 million yuan, and the total Liu invested was 6.9 billion yuan.

Liu began his bag manufacturing business with a starting fund of 100 yuan, became rich by buying treasury bonds and turned famous by hoarding legal shares. The value of his properties increased to 10 billion yuan over the past 19 years.

Liu is also interested in the art market. In the past year, he spent more than 400 million yuan on his art collection.

Related:

3. Chen Fashu: King of cash-In

Chen Fashu, chairman of the New Huadu Industrial Group based in Fujian province, cashed in 4.2 billion yuan ($615.14 million) in about half a year and was regarded as the "king of cash-in."

Chen and his company began to reduce the holdings of Zijin Mining Group on April 27. As of Nov 24, they had sold 557.23 million shares of Zijin and cashed in about 4.2 billion yuan.

On Oct 20, Chen announced plans to set up the New Huadu Philanthropic Fund and donate about 8.3 billion yuan worth of equity to the country's largest private philanthropic fund.

Since donations to charity foundations can enjoy tax deductions or exemptions in China, some questioned Chen's motives.

Related:

4. Li Jian: from deputy mayor to 'stock master'

Li Jian, ex-deputy mayor of Shaoguan city, Guangdong province, bought a block of 64,200 shares for 10.66 yuan each issued by Xi'An Aircraft International Corp on July 1 and sold the shares for 13.33 yuan each on July 15 to make 170,000 yuan. On Aug 5, Li Jian was hired by Aviation Industry Corporation of China (AVIC) as deputy manager. The amazing high-speed trading and the new position have placed Li Jian under the spotlight.

Li doesn't see himself as a 'stock master,' and neither has heard any inside information about this stock from AVIC. "To apply for the position of deputy manager of AVIC, I did my research by analyzing the stocks issued by Xi'An Aircraft International Corp," Li said.

5. Wu Mingxiao: ST specialist finds gold at ST companies

Wu Mingxiao was nicknamed 'ST specialist' because he invests mostly in stocks capped with the label of "special treatment," or ST, on the stock exchange to alert investors to its poor performance. According to Q3 results of listed companies, Wu appears on the lists of top ten tradable shareholders of nine listed companies, eight of which are ST companies.

Information showed that Wu participated in the reorganization of Shanghai Forever Co Ltd and Hubei Xingfu (Group) Industry Co Ltd and made quite a fortune. In 2007 and 2008, Wu became famous for his successful bids for ST Shanghai Broadband Technology Co Ltd and ST Guangxi Beisheng Pharmaceutical Co Ltd.

0

0