China unveils 1st sovereign credit rating report

A Chinese company on Sunday unveiled China's own sovereign credit rating report, for the first time evaluating 50 countries and becoming the first non-Western rating agency to assess the world's sovereign credit and risks.

The report by Dagong Global Credit Rating Co., Ltd., the first domestic rating agency in China, was released at a time when many complain the Moody's Investors Service, Standard & Poors and Fitch Ratings were partly to blame for the recent global financial crisis as well as Greece's debt woes.

Dagong's report covered 50 countries whose gross domestic product (GDP) accounts for 90 percent of the world's total economy, and gave markedly different valuations to 27 countries compared with those given by Western rating rivals Moody's, Standard & Poors and Fitch.

For instance, Brazil and other emerging economies were rated higher by the Chinese firm, citing political stability and strong economic growth.

At the same time, the United States, France and other developed nations were rated much lower in Dagong's report due to their slow economic growth and increasing debt burden.

Guan Jianzhong, chairman of Dagong, said during a press conference in Beijing to introduce China's first sovereign credit rating report, that the current Western-led rating system "provides incorrect credit-rating information" and fails to reflect changing debt-repayment abilities.

"We want to make realistic and fair ratings and mark a new beginning for reforming the irrational international rating system," Guan said.

Dagong said it rated the 50 countries according to its own credit rating standards for the sovereign entity of a central government, which include "the ability to govern a country, economic power, financial ability, fiscal status and foreign reserve".

In the report, Dagong rated U.S. government debt AA with a negative outlook, which was lower than the firm's top AAA rating. It warned that Washington, along with Britain, France and other countries, might have trouble raising more money if they let fiscal risks get out of control.

"The interest rate on debt instruments will go up rapidly and the default risk of these countries will grow even larger," the report said.

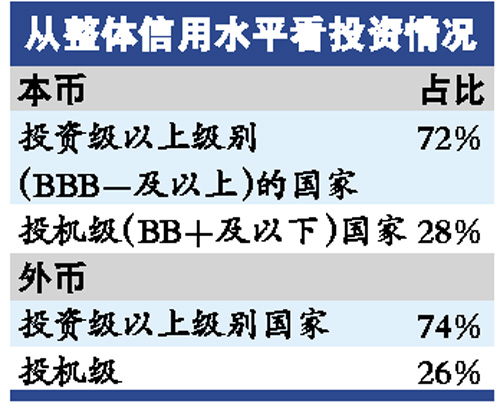

Dagong gave China's yuan-denominated debt an "AA-plus" rating with a stable outlook -- higher than Moody's "A1" and S&P's "A-plus" -- due to its rapid growth and relatively low debt. China's foreign currency rating was "AAA" in Dagong's report.

In terms of domestic currency-denominated debt, Norway, Denmark, Luxemburg, Switzerland, Singapore, Australia and New Zealand received the top rating of AAA. Canada, the Netherlands and Germany received "AA-plus" rating.

Japan received an "AA-minus" rating, according to Dagong's report.

Dagong said it hopes to "break the monopoly" of Moody's, Standard & Poors and Fitch, whose reputation was tainted by their high ratings to mortgage-related investments that led to the global financial crisis.

Wu Hong, who led a task force to study credit rating and national security in China, said it has become a trend for other countries to set up their own credit rating agencies and reject the currently unfair international rating system controlled by Western companies.

"This means a historic opportunity for China to participate in making the new rules of international ratings," Wu said, adding China still has a long way to go to increase its own influence in the credit rating system.

Also, Western rating agencies fail to give China full credit for its economic strength, thus boosting China's borrowing costs, Wu noted.

The National Association of Financial Market Institutional Investors is also considering setting up another rating company with China's commercial banks and insurance companies.

Founded in 1994, privately owned Datong provides credit rating and risk analysis research for all bond issuers in China, with more than 500 employees.

It also designs most domestic debt instruments and leads the Chinese credit rating market in corporate bonds, financial bonds and structured financing bonds.

Go to Forum >>0 Comments

Add your comments...

Add your comments...

- User Name Required

- Your Comment

- Racist, abusive and off-topic comments may be removed by the moderator.

0

0