Imports, car sales fuel 23% tax revenue

|

|

|

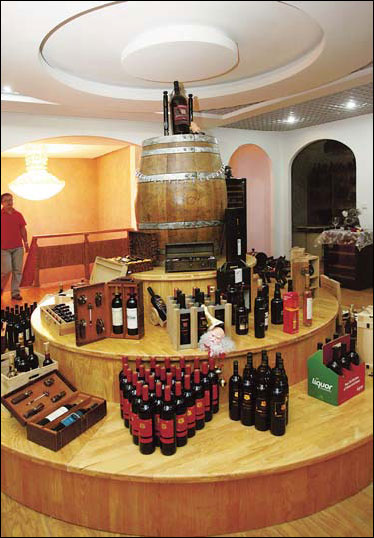

A display of imported wine at a vineyard in Nanjing, Jiangsu province. A jump in China's 2010 tax revenue as a result of surging imports and car sales has prompted calls for tax cuts. [China Daily] |

Driven by the large volume of imports and car sales, China's tax revenues jumped 23 percent year-on-year to reach 7.32 trillion yuan ($1.1 trillion) last year, sparking calls for tax cuts.

Tax authorities collected 1.05 trillion yuan of value-added and consumption taxes for imported goods in 2010, up 31.1 percent year-on-year, the Ministry of Finance said on its website. Import tariff revenues jumped 52.8 percent year-on-year to 202.75 billion yuan.

China's trade surplus decreased by 6.4 percent in 2010 compared with 2009, thanks in part to growing imports. Import volume increased 38.7 percent year-on-year to 1.39 trillion yuan in 2010, outpacing export volume growth, which was 31.3 percent, General Administration of Customs data showed.

"China's export growth will slow to a still-strong 10 percent this year, and its surplus is set to contract by 2015," Chen Deming, the commerce minister, said in an interview last month. "China's imports will probably grow faster than exports in 2011."

The expanding volume of vehicle sales was another major contributor to last year's robust revenue hike. In 2010, China's auto sales continued their robust growth to reach 18.03 million units, climbing by 32.37 percent year-on-year, compared with 13.6 million units in 2009.

Despite the sharp tax revenue increase, cities such as Chongqing and Shanghai announced last month they would start levying property tax on holdings of multiple or high-end residential properties, while media reported on Wednesday that the central government may extend the resource tax nationwide - a tax based on the production of oil and other resources - this year, all aimed at increasing income and reducing the burden on tax-laden local governments.

Amid the blistering increase in tax revenues, the public and analysts have called for tax cuts to reduce the burden on low earners.

"Our tax level was too high," said an Internet user called Yi Yi on the major Chinese portal Tencent.com. "I hope the income tax rate will be reduced, and better social security should be provided for the middle- and low-income earners."

"Middle- and low-income earners are the major tax sources in China, as all their revenue are under supervision by the tax bureau," said Mao Yushi, senior economist with the Beijing-based Unirule Institute of Economics. "By contrast, it is very hard for the tax authorities to monitor the income of the high earners because most of that income is 'invisible' (thanks to the nation's ineffectual income tracking system)."

Earlier reports said China has drawn up a framework for personal income tax reform by raising the taxable threshold to benefit low earners.

In addition, policymakers might replace business tax with value-added tax, from which more businesses would benefit through increased tax deductions.

The Ministry of Finance said earlier that it will pay more attention to issues concerning people's livelihood, such as education, healthcare, housing and agriculture.

0

0