Alibaba execs resign over supplier frauds

|

|

|

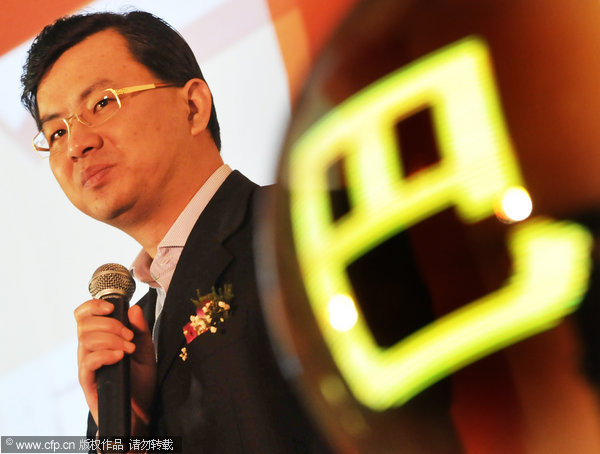

Alibaba.com Ltd's chief executive officer David Wei resigns over supplier frauds. |

China's top e-commerce operator Alibaba.com Ltd's chief executive officer David Wei resigned after the company found more than 2,000 members engaged in fraudulent activities, reflecting problems hidden behind the company's fast expansion over the past few years.

Wei and the company's chief operating officer Elvis Lee resigned to take responsibility for the fraudulent sales among its China Gold Suppliers, the Hong Kong-listed Alibaba.com said in a statement on Monday.

Jonathan Lu, who heads Alibaba Group's consumer-to-consumer business arm Taobao.com, was appointed as new chief executive officer to replace Wei.

"Any tolerance of this type of affront to business ethics and company values is a crime against the rest of our customers," said Jack Ma, chairman of Alibaba Group, in a letter to employees.

He added he had experienced "a lot of torment, a lot of frustration, a lot of anger" for the past month.

The company found that 1,219 of its China Gold Supplier customers who signed up in 2009 and 1,107 who signed up in 2010 engaged in fraud against our buyers, according to the statement.

The increase in Alibaba.com supplier numbers has largely surpassed that of its overseas buyers, and this has led to some suppliers' fraudulent sales, Tang Mingjun, an analyst with Shenyin & Wanguo Securities, said.

The company's customers whose exports account for about 10 percent of its total but contribute about 70 percent of its revenues, according to Tang.

The slowdown of customer growth after the financial crisis has put pressure on the company, with declining stock prices.

"The incident is likely to have a negative impact on Alibaba's image and its shareholders' confidence," Tang said.

Alibaba.com said the incident will not have "a material financial impact" on its previous financial periods because the fraudulent activities and its reaction to them have been appropriately accounted for in previously reported financial periods.

Wallace Cheung, an analyst with Credit Suisse, said in a research note on Monday that he does not expect the resignations to significantly affect the company.

But investors will have questions about "future cross-company transactions and ways to avoid conflicts of interest between both Alibaba and Taobao, because Taobao remains a private sister company," he said.

Alibaba's shares fell by 3.47 percent to HK$16.68 ($2.14) on Monday before the announcement.

0

0