Turn liquidity to advantage, adviser says

China is unlikely to resort to a sharp appreciation of the yuan to tackle inflation pressure, said a senior government economic adviser.

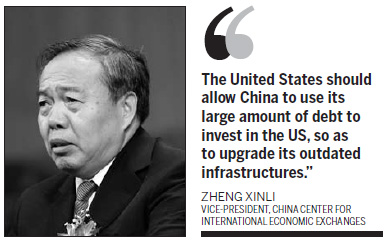

Instead, the country should impose more regulations and launch stimulus packages to direct excessive liquidity to areas that can help it to restructure the economy, said Zheng Xinli, vice-president of the China Center for International Economic Exchanges.

He told China Daily that a sharp appreciation of the yuan will greatly damage the nation's economic recovery.

"More than half of China's exports are conducted by foreign companies that would move their manufacturing capacity to other markets under a sharp yuan appreciation," Zheng said.

He said China's foreign-currency reform should be gradual and keep to a pace that puts "some, but not too much" pressure on Chinese exporters.

Zheng is a former deputy director of the Policy Planning Office under the Central Committee of the Communist Party of China. He has been involved in drafting several annual working reports of the State Council and the 8th to 11th Five-Year plans.

Zheng said he believes that the appreciation of the yuan should be a natural thing as China's economy continues to expand but that a "2 to 3 percent appreciation of the yuan each year" would be appropriate for the economy.

As China's CPI has continued to run at a high level during the past few months, many experts suggest that the nation should accelerate the appreciation of yuan to curb rising prices.

On Tuesday, the currency rose toward a 17-year high after Financial News quoted Liu Mingkang, chairman of the China Banking Regulatory Commission, as saying the yuan had entered a period of "one-way appreciation".

However, Zheng ruled out the possibility of a sharp rise in the yuan and said that the currency's appreciation is not the only solution to rein in inflation. "From another point of view, the excessive liquidity could be an opportunity if it is directed to where it is needed," he said.

He suggested that the central government should launch regulations to steer liquidity to expanding China's capital markets, upgrade the industrial structure and support strategic industries such as new energy and healthcare.

As a senior government adviser, Zheng also said that China should reduce its holdings of US debt and increase investment in critical technology and resources in foreign countries.

"The United States should allow China to use its large amount of debt to invest in the US, so as to upgrade its outdated infrastructures," he said.

According to data released by the US Treasury Department on Monday, China held $1.16 trillion in US government debt in December, almost one-third more than previously thought.

Zhang Monan, a researcher at the State Information Center, a think tank under the National Development and Reform Commission, told China Daily on Wednesday that the nation has not altered its long-held policy of reducing US debt holdings over the long term.

"China will soon launch its foreign-reserve reform that will encourage Chinese companies and even individuals to hold foreign reserves," said Zhang. That, she said, will inevitably result in China reducing its holdings of US debt in the years to come.

She estimates that the "appropriate" amount of China's holding of US debt should be between $800 billion to $1 trillion.

Go to Forum >>0 Comments

Add your comments...

Add your comments...

- User Name Required

- Your Comment

- Racist, abusive and off-topic comments may be removed by the moderator.

0

0