U.S. investors keen on China's financial sector

- By Yang Xi

0 Comment(s)

0 Comment(s) Print

Print E-mail

China.org.cn, November 29, 2011

E-mail

China.org.cn, November 29, 2011

|

|

|

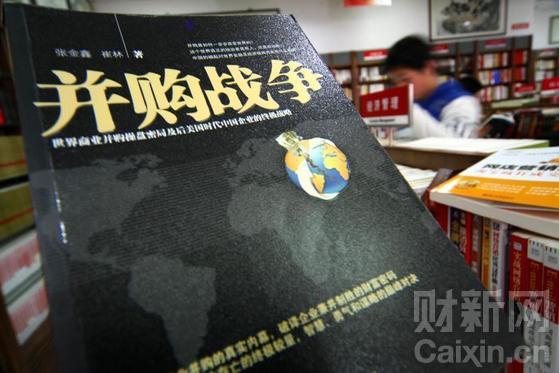

U.S. mergers and acquisitions of Chinese companies have centered on the financial service sector in recent years. [Photo/Caixin.cn] |

U.S. mergers and acquisitions of Chinese companies have centered on the financial service sector in recent years, with financial sector deals accounting for half of all M&A transactions in China, according to a report released by The Mergermarket Group, Caixin.cn reported Tuesday.

Mergers and acquisitions of Chinese enterprises by U.S. investors from 2006 to the 3rd quarter this year were worth US$38 billion, while Chinese M&A deals involving U.S. companies over the same period were worth $15.6 billion.

U.S. investors have become more interested in purchasing Chinese banks and insurance companies as the global financial crisis has worsened, the report said.

China‘s M&A activities in the U.S.have focused on energy, mining and public utilities. The three sectors accounted for 43.3 percent of the total value of transactions since 2006.

China's business press carried the story above on Tuesday.