Dispute adds to Tokyo's woes

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, October 23, 2012

E-mail China Daily, October 23, 2012

Exports to China, Japan's largest trade partner, are the source of 2.8 percent of Japan's GDP, and its total exports usually contribute 14 to 17 percent of its economic growth.

Japanese government lowered its economic expectations for a third straight month in October, as economic indicators showed decreasing machinery orders in August, indicating that the world's third-largest economy may be seeing the longest economic slowdown since the 2009 global recession.

"Japan's exports to China may continue to decline in the coming months as the two countries have yet to find a way to resolve the issue," said Yao.

Data from China's General Administration of Customs showed that the value of Sino-Japanese trade fell 4.5 percent year-on-year in September, when China saw an increase of 2.2 percent in its exports to Japan and a 9.6 percent decrease in imports.

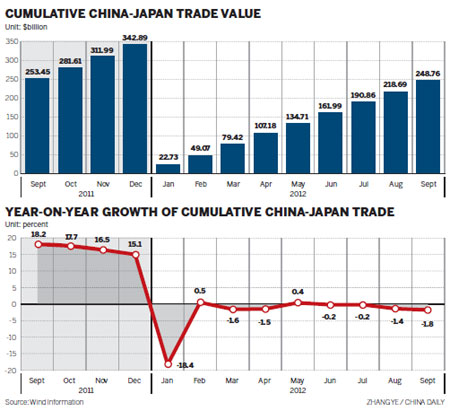

In the first nine months, the countries' trade saw a net decrease of 1.8 percent year-on-year to $248.7 billion, according to the General Administration of Customs.

A report from the global market research provider Ipsos Business Consulting said the number of Japanese cars sold in China fell to 122,200 in September from 175,200 in August.

The company said the chief contributor to the decline in sales was "the Chinese people's strong reaction to the Diaoyu Islands dispute".

The dispute has also affected Japan's foreign direct investment in China.

By the end of the third quarter, the growth of Japan's investment in China this year had slowed to 17 percent from 50 percent in the same period last year, reaching a total volume of $5.62 billion, according to the Ministry of Commerce.

In the longer term, strained China-Japan relations may also hurt China's economy, specially in cross-border trade and investment, experts said.

"It is important to figure out how to control the dispute and take measures to maximize the two countries' common interests," said Ju Jiandong, a professor at the School of Economics and Management at Tsinghua University.