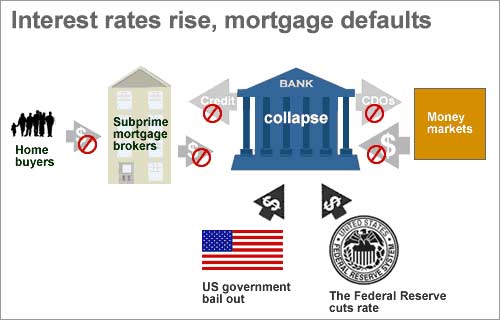

Most analysts link the current financial crisis to the sub-prime mortgage business, in which US banks gave high-risk loans to people with poor credit histories. These and other loans, bonds or assets are bundled into portfolios – or Collateralized Debt Obligations (CDOs) – and sold on to investors globally.

The crisis began with the bursting of the United States housing bubble and high default rates on "subprime" and adjustable rate mortgages (ARM), beginning in approximately 2005–2006.

The roots of the crisis stretch back to another notable boom-and-bust: the tech bubble of the late 1990’s. When the stock market began a steep decline in 2000 and the nation slipped into recession the next year, the Federal Reserve sharply lowered interest rates to limit the economic damage.

Lower interest rates make mortgage payments cheaper, and demand for homes began to rise, sending prices up. In addition, millions of homeowners took advantage of the rate drop to refinance their existing mortgages. As the industry ramped up, the quality of the mortgages went down.

However, once interest rates began to rise and housing prices started to drop slightly in 2006–2007 in many parts of the US, refinancing became more difficult. Defaults and foreclosure activity increased dramatically as easy initial terms expired, home prices failed to go up as anticipated, and ARM interest rates climbed.

Foreclosures accelerated in the United States in late 2006 and triggered a global financial crisis through 2007 and 2008. During 2007, nearly 1.3 million US housing properties were subject to foreclosure activity, up 79 percent from 2006. Major banks and other financial institutions around the world have reported losses of approximately 435 billion US dollars as of July 17, 2008.