Property prices up by 12.8% in April

China's property prices rose by a record 12.8 percent year-on-year in April, due to a comparatively low base in 2009 and a time lag for tightening real estate policies to take effect.

China's property prices rose by a record 12.8 percent year-on-year in April, due to a comparatively low base in 2009 and a time lag for tightening real estate policies to take effect.

According to the National Bureau of Statistics (NBS), the April increase topped an 11.7 percent jump in March that was the highest since the survey of residential and commercial prices in 70 cities started in July 2005.

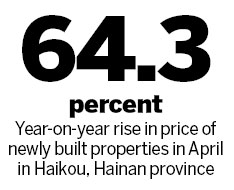

Notably, newly built house prices in Haikou, Hainan province, skyrocketed 64.3 percent year-on-year, followed by 58.2 percent in Sanya, also in Hainan, and 26.1 percent in Wenzhou, Zhejiang province.

"As last April's price growth was negative and the government's tightening measures were launched in mid-April this year, last month's record high price rise remained within expectations, and the growth rate will drop in May," said Qin Xiaomei, chief researcher with property consultancy firm Jones Lang LaSalle Beijing.

On April 16, the central government launched a string of measures to dampen property speculation, followed by more detailed rules from local governments.

Those measures, such as raising down-payments and mortgage rates for second and third homes and restricting pre-sales by developers, have chilled the sizzling markets in key cities, evidenced by dropping sales and falling prices in May.

Statistics from the China Index Academy show that among the 35 major cities it monitors, transactions dipped in 26 cities last week, with an average fall of more than 20 percent.

The average price of home deals in the southern city of Shenzhen was 19,271 yuan ($2,821) per sq m, down 25.44 percent from the previous week, the biggest drop among the 35 cities.

Beijing was down 18 percent at 15,707 yuan per sq m, and Shanghai declined 12.2 percent to 13,246 yuan per sq m. Hangzhou, capital of East China's Zhejiang province, however, reported a 49.2 percent increase in transactions and 25 percent growth in prices, with the average price reaching 25,409 yuan per sq m last week.

"In cities that have experienced excessive property price growth, there will be bigger fluctuations in the following three months, but the decrease will differ from city to city," said Nie Meisheng, president of China Real Estate Chamber of Commerce.

Meanwhile, as new supply will catch up in the second half year, the imbalance between the supply and demand will gradually improve, thus easing price growth pressures, according to Qi Fan, an analyst with real estate consultancy firm Century 21.

According to the NBS, the floor space of newly started projects increased 64.1 percent in the first four months to 457 million sq m.

Property developers acquired 91.8 million sq m during the same period, up 26.4 percent year-on-year.

Go to Forum >>0 Comments

Add your comments...

Add your comments...

- User Name Required

- Your Comment

- Racist, abusive and off-topic comments may be removed by the moderator.

0

0