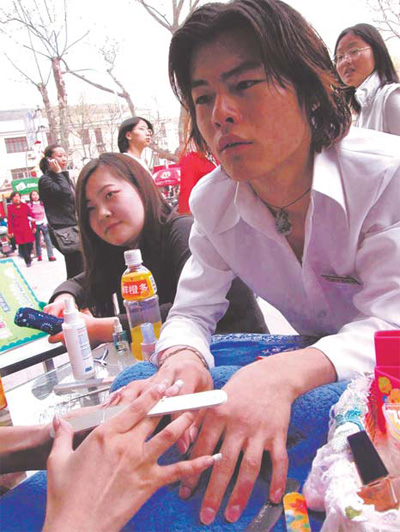

Males turn to cosmetic appearance

Beauty bestsellers

Whatever the motivation, the more time Chinese men spend in front of the mirror, the better it gets for the cosmetics industry's major players.

The men's skincare market in China was estimated to be worth $269.6 million in 2010, slightly higher than the $227.4 million in North America. According to Euromonitor's forecasts, the Chinese market will see annual growth of 29 percent between 2009 and 2014, compared to 5.7 percent in North America and 7.9 percent in Europe.

L'Oreal SA, the world's largest cosmetics company, introduced Biotherm Homme to China in 2003, before marketing its popular Men Expert three years later. The product retails for more than 100 yuan ($15).

Euromonitor figures show L'Oreal claimed a 32-percent share of the Chinese market in 2009.

"We estimate that the men's cosmetics sector has grown at twice the rate of the total beauty market in China," said Alexis Perakis-Valat, chief executive of L'Oreal China, "and it's only the beginning.

"Chinese men are modern and do not have any taboos," he added. "They're pragmatic and they see that looking good and being groomed are great ways to boost self-esteem and play a role in improving relationships in their families, with their friends and at work."

Perakis-Valat said L'Oreal is leading the field in each sector: Biotherm for the luxury market, L'Oreal Paris for the premium mass market and Vichy for the pharmacy market.

Last year, the company also began selling Garnier, a brand aimed at entry-level cosmetics users, in third- and fourth-tier Chinese cities. Other companies that have entered the market in recent years include Beiersdorf AG with Nivea, Japan's Shiseido with Aupres JS and Proctor and Gamble (P&G), which has so far only released in China its Olay for Men.

Domestic brands have also met with much success. The State-owned Shanghai Jahwa United has seen its range of gf (it is pronounced gaoerfu, meaning golf) products go from strength to strength. The company recently released a product that includes desert plants to improve skin resistance in tough environments.

"Innovation and development has also boosted the Chinese market," said Kevin Zhu at Euromonitor. "It's gone from simply cleaning and moisturizing products to more sophisticated lines, like anti-aging and anti-oxidation creams."

The compound annual growth rate of the entire cosmetics industry soared from $44.83 billion in 2002 to $66.6 billion in 2009, and is expected to hit $77.84 billion by 2012.

However, compared to women's cosmetics in China, the men's market is still relatively undeveloped, meaning there is lots of room for new products, added analyst Zhu.

He predicted that affordable and widely distributed products will see the biggest growth.

Research by P&G already suggests roughly 65 percent of Chinese men are using skin-cleaning products.

However, while sales of moisturizers and lotions may be on the rise, few men are regularly buying facial masks, said Tian Xun, an editor of Esquire China, a fashion bible for young men.

"China's male grooming market has just taken off and Chinese consumers are in the process of adopting a systematized beauty concept," said Alexander Dony, managing director of male grooming at P&G Greater China.

The strategy at P&G is to build a range of skincare, shaving, body- care and hair-care products that satisfy the increasingly complicated demands of Chinese men, he added.

0

0