Global Themes

· 2004 was a robust year for the global economy, especially for developing countries, where GDP grew by a record 6.6 percent. The global recovery strengthened, with much of the momentum coming from the United States and the East Asia / Pacific region (notably China), and broadened, with a pickup in Latin America, acceleration in Japan, and modest recovery in the European Union.

· Driven by favorable global conditions and strong domestic performance at home, the strong recovery of capital flows to developing countries that began in 2003 carried over to 2004, albeit at a reduced pace. Total private and official net debt flows totaled a record high of US$324 billion, up significantly from US$200 billion during 2000-02 and just above the US$323 billion level reached in 1997. In relative terms, the pickup is much more modest -- net capital flows to developing countries equaled 4.5 percent of their GDP in 2004, significantly below highs exceeding 6 percent reached in the mid-1990s.

· Drawing on healthy trade balances, the current account surplus for developing countries as a group continued to widen, reaching 2.0 percent of GDP in 2004, up from 1.8 percent in 2003 (a dramatic turnaround from an average deficit position equal to 1.5 percent of GDP over the period 1976-2000). Combined with expanding capital flows, the growing surpluses contributed to accelerating reserve accumulation. Foreign reserves in developing countries increased by US$378 billion during 2004, up from US$292 billion during 2003. Although the largest reserve accumulation was concentrated in Asia, particularly in China where reserves increased by US$207 billion, the phenomenon was widespread. More than three-quarters of developing countries accumulated reserves during 2004. A sizable portion of this new accumulation is invested in US Treasuries, indicative of the growing stake of developing countries in the functioning and health of the global financial system.

· FDI inflows to developing countries increased from US$152 billion in 2003 to US$165 billion in 2004, but remains below the peak of US$182 billion reached in 1999. While the concentration of FDI flows remains high (five emerging-market economies?China, Brazil, Mexico, Russia and India?account for 60 percent of FDI, and 88 percent of the increase), the share flowing to low-income countries reached 11 percent, the highest in 15 years. Reported FDI outflows from developing countries surged dramatically, reaching an estimated US$40 billion in 2004, up from only US$3 billion in 1991. The bulk of the FDI outflows originated in countries that had been major recipients of inflows in recent years.

· Net medium- and long-term bond flows rebounded sharply, reaching a record high of US$63 billion, up from US$27 billion in 2003 and US$11 billion in 2001/02. Net international medium- and long-term bank lending declined by US$2 billion in 2004. Gross bond issuance surpassed gross bank lending for the first time, although bank lending remains available to a larger group of countries. The strong gains in bond issuance over the past two years reflect both supply and demand factors – ample global liquidity, low advanced-country interest rates promoting a “search for yield,” and a broad-based improvement in credit fundamentals in many emerging markets. The EMBI index of emerging-market bond spreads fell steadily during 2004, falling below 350 basis points by the end of the year.

· Figures for 2004 confirm the continuing structural shift in development assistance from loans to grants over the last several years. Foreign aid grants have increased by a cumulative total of US$20 billion over the past three years, while net official lending (to both middle- and low-income borrowers) has declined by US$52 billion, implying a US$32 billion decline in net official flows (aid and lending combined). The largest factor underlying this shift has been a US$30 billion net decline in lending by the IMF, reflecting repayment of sizable crisis-related disbursements made in 2001. But net lending by the World Bank also fell by US$9 billion over the period, as several countries repaid large structural adjustment loans and other Bank loans were repaid ahead of schedule.

· While figures for 2004 are not yet available, official development assistance (ODA) increased by just over US$10 billion in 2003 to US$69 billion (although after accounting for inflation and exchange rate changes, the real increase was only 4 percent). Sub-Saharan Africa has received 60 percent of increases in ODA disbursements over the five-year period 1998 to 2003. However, most of these funds were allocated to post-conflict situations, leaving little for development aid. ODA as a share of GNI in donor countries is projected to rise from 0.25 percent in 2003 to 0.30 percent in 2006—implying a 10 percent annual increase in ODA in real terms, about double that achieved over the past two years.

Regional themes

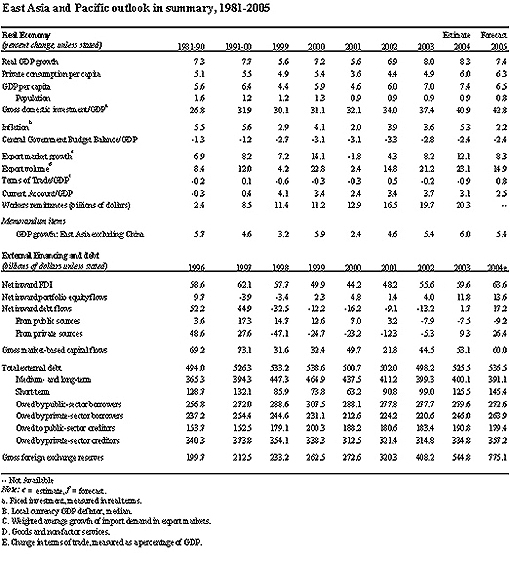

· The economies of East Asia and the Pacific grew by 8.3 percent in 2004, up slightly from 8.0 percent in 2003. Growth in the region over the past two years was the strongest since the financial crisis in 1997/98. The expansion was particularly robust in China, where the economy grew by 9.5 percent, but the pickup was widespread. Growth of most economies in the region accelerated in 2004, including middle-income economies like Indonesia, Malaysia and the Philippines, as well as low-income economies like Lao PDR, Vietnam, Papua New Guinea and Mongolia.

· A supportive external environment characterized by a record expansion in world trade, regional current account surpluses and rising foreign reserves has bolstered investor confidence in many economies. Growth in the region is projected to decline to a more sustainable rate of 7.4 percent in 2005, with China continuing to be the dominant economy in the region.

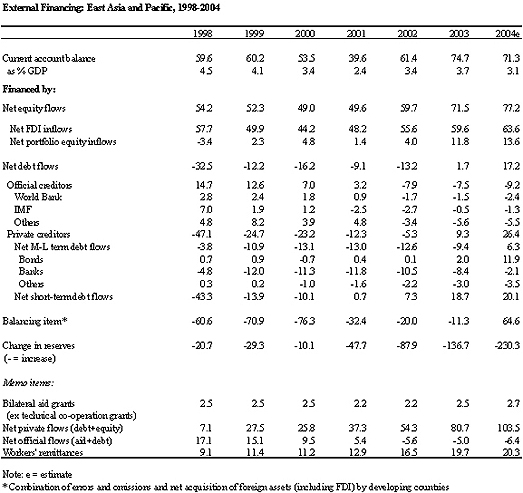

· Net private (debt and equity) flows to the region have increased dramatically since the Asian crisis in 1997/98, reaching US$103.5 billion in 2004, up from a low of US$7.1 billion in 1998. The US$96.5 billion increase largely reflects a US$73.5 billion increase in net private debt flows, along with a US$23.6 billion increase in net equity inflows to the region.

· Net private debt flows have rebounded from a record US$47.1 billion outflow in 1998 to inflows of US$9.3 billion in 2003 and US$26.4 billion in 2004. The strong rebound stemmed from a US$63.4 billion swing in net short-term debt flows; medium- and long-term debt flows increased by only US$10.1 billion over this period. Medium- and long-term bond inflows reached US$11.9 billion in 2004, up sharply from US$2.0 billion in 2003 and an average level of less than US$0.5 billion over the previous five years. Net medium- and long-term bank lending continued to contract, declining by a US$2.1 billion in 2004, albeit at a more gradual rate than in previous years (US$8.4 billion in 2003, US$10 billion on average over the previous five years).

· Net official flows to the region have been negative for the past three years as countries continue to make sizeable net repayments to official creditors on loans made following the Asian crisis in 1997/98. In contrast, bilateral aid grants have remained relatively stable, averaging US$2.4 billion since 1997.

· FDI flows into the region have increased gradually since the Asian crisis, reaching US$63.6 billion in 2004, up from a low of US$49.9 billion in 1999. China accounted for 88 percent (US$56.0 billion) of FDI inflows to the region in 2004, just slightly above the average over the previous five years (87 percent). Most of the remaining FDI inflows in 2004 went to Malaysia (US$2.8 billion), Vietnam (US$1.8 billion), and Indonesia (US$1.7 billion).

· Net portfolio equity inflows to the region have increased dramatically over the past three years, reaching US$13.6 billion in 2004, up from US$1.4 billion in 2001. China accounted for 78 percent of the portfolio equity flows to the region, up from 65 percent in 2003.

· Foreign reserves held by countries in the region increased by US$230 billion in 2004, following a US$136.7 billion increase in 2003. China accounted for 90 percent (US$207 billion) of the increase in 2004, 85 percent (US$117 billion) in 2003. With gross reserves of US$610 billion in 2004, China holds almost 80 percent of reserves in the region, and 38 percent of reserves held by all developing countries, up from 33 percent in 2003.

· The value of external debt in the region increased from US$498 billion in 2003 to US$525 billion in 2004, but has declined significantly as a proportion of GDP, reaching 23.2 percent in 2004, down from 36.8 percent in 1999.

Other key regional points to note

· Bond spreads in the region have narrowed considerably in recent years and credit ratings have improved markedly, reflecting lower default risk associated with the lower external debt burdens, ample foreign reserve holdings and important advances in the domestic policy environment.

· Although the external debt burden for the region as a whole has declined over the past few years, the domestic debt burden remains high in many countries following the financial crisis of 1997/98. Fiscal balances in some countries could worsen significantly if interest rates were to increase sharply.

· The policy environment has improved significantly in many countries in the region, especially those directly involved in the financial crises in 1997/98. Countries have adopted more market-oriented financial policies, and have strengthened the supervisory/regulatory environment governing the corporate sector. Moreover, there have been major advances in international trade and investment within the region, as well as with other regions.