Key issues in China's tax reform

- By John Ross

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, November 29, 2013

E-mail China.org.cn, November 29, 2013

Tax reform is one of the most widely discussed issues in China. It is far from being unique in that! In the U.S., disputes over health care payments and taxation of better-off citizens underlined the recent government shutdown. Who will pay the tax increases which are inevitably coming in China, as it begins to build a more comprehensive health and social security system, will be key not only for its economic development but for its future social stability

In all countries, including China, economic strategy must determine the direction of effective tax reform. Attempts, which are sometimes made, to analyze tax reform without situating this within overall economic dynamics necessarily result in discussion and policy which is abstract, ineffectual and risks creating social instability.

The links between tax reform, economic development and social stability are precise. Clearly, taxes are not a goal in themselves but merely the means to finance government expenditure. China must therefore face the fundamental reality that as it makes the transition from a "developing economy" to its current goal of a "moderately prosperous" society, and eventually to a "high income" economy, the proportion of government spending in GDP will increase. As government spending must eventually be financed via taxes, this means taxation in China will also have to increase. Who pays these taxes will therefore necessarily greatly affect social stability. Therefore for tax reform to be effective, discussions of short and medium term measures must be integrated into this longer term perspective.

The issue may indeed be stated bluntly: If the struggle against corruption is today in the forefront of discussion of China's social stability, in the medium term, the type of tax system created will be equally decisive.

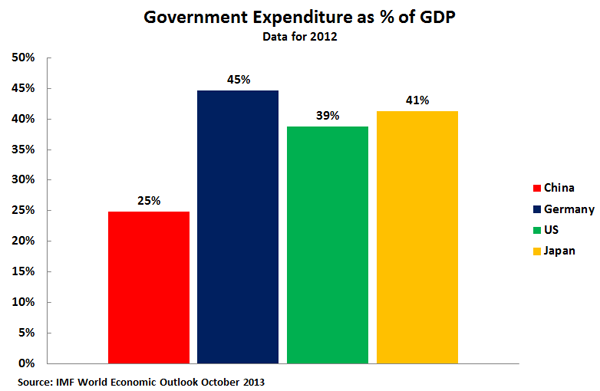

To take the most fundamental starting point, the chart below shows why increases in taxation are inevitable in China as it becomes a more developed economy. It shows how much lower China's government expenditure is as a proportion of GDP than in an advanced country – the comparison is of China with the leading industrial economies. Not only is the 25 percent of GDP accounted for by state spending in China much smaller than the 45 percent in Germany, and 41 percent in Japan, but it is far lower than the 39 percent in the U.S. – an advanced economy normally taken as a model of small government. As government expenditure, except in the purely short term, must be financed by taxation, the increase in government expenditure that will take place as China makes the transition to a more advanced economy necessarily requires corresponding increases in taxation.

Attempts to avoid this reality result either in self-contradictory proposals – such as the suggestion that China needs lower taxation and increased social safety net spending at the same time, to stimulate household consumption – or rely on measures which are temporary and economically destabilizing – such as the present excessive reliance of local government on land sales.

Many authors on China's economy have pointed to immediate urgent priorities in social spending, but these have immediate tax implications. For example, for China's 260 million migrant workers, coverage of employers paying pension insurance is only 14 percent, industrial injury insurance 24 percent, and unemployment insurance 8 percent. Given that coverage of such taxes would essentially be 100 percent in an advanced economy, the expansion of employers' tax coverage in China which is to come in is clear – personal taxation is dealt with below.

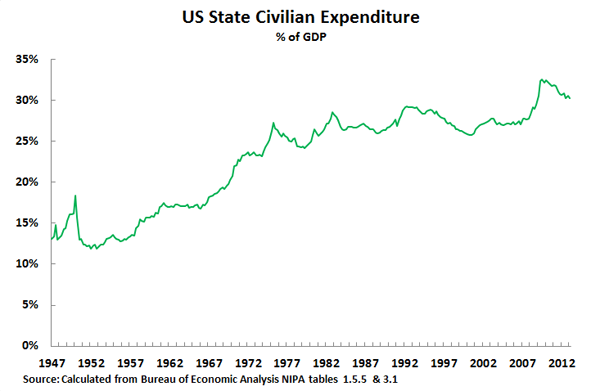

More fundamentally, to see the overall trajectory of government spending in an advanced economy, the chart below shows U.S. civilian government expenditure. This rose from 12.3 percent of GDP in 1947 to 30.4 percent of GDP in the 2nd quarter of 2013, the latest available data. This rise in the proportion of government spending in the U.S. economy was driven by precisely the same forces that will operate in China's urbanization and economic development – the cost of urban infrastructure construction and establishment of a social safety net.