Prospect of RMB depreciation depends on what China’s central bank wants

- By Yi Xianrong

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, January 28, 2016

E-mail China.org.cn, January 28, 2016

|

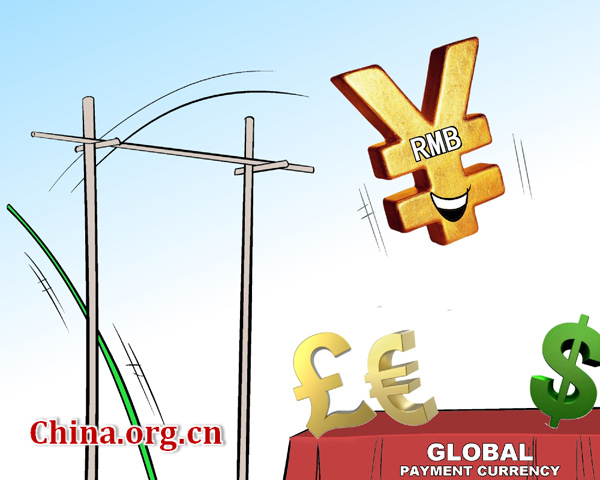

[By Jiao Haiyang/China.org.cn] |

Recently, China experienced financial market chaos that was much related to the RMB depreciation following the New Exchange Rate Reform on Aug. 11, 2015. The reform was meant to intensify the marketization of the RMB exchange rate formation mechanism to meet the free-use criteria for the RMB inclusion in the SDR currency basket. But it stirred a big turmoil in the global financial market and a continuous depreciation of the RMB.

Especially after IMF announced the SDR decision on Dec. 12, the depreciation trend of the RMB was more obvious and grew into a depreciation tide of short-selling the RMB exchange rate in the offshore market. China’s central bank had to counterattack. The recent capital outflow, stock-market crash and the big turmoil in the global market were all related to the continuous RMB depreciation.

Unlike in the gold standard era, neither the gold content of the RMB nor the performance of the real economy, nor international trade relations can determine an equilibrium RMB exchange rate. Under the international monetary system led by the US credit money, the exchange rate of one currency against another currency does not have much relevance to actual economic activity. Predictably, when over 98% of the present global exchange rate transactions are not related to actual trade, a currency exchange rate does not have much relevance to the real economy. So, the exchange rate of one currency against another currency is completely the result of interest gambling among countries. Therefore, the RMB exchange rate should be interpreted in terms of China’s national interests and needs that Chinese government has recognized.

Before the New Exchange Rate Reform, China wanted to enhance its giant economic status in the international market and took the method of a continuous RMB appreciation. The reform was designed to ensure the RMB’s inclusion in the SDR currency basket. In the wake of that success, China has felt the high cost of keeping a stable RMB exchange rate and hoped to lead the RMB to a downward movement so as to increase the flexibility of the rate, thus launching a CFETS RMB exchange rate index to inform the market of the fact that the RMB does not depreciate, etc. Because the Chinese government determines the RMB exchange rate at its discretion, the market basically has no idea of where the Chinese government goes: Will it promote the process of the RMB internalization or reinforce the marketization of the RMB exchange rate formation mechanism? Will it stabilize the RMB exchange rate or let the RMB exchange rate depreciate to boost exports? The lack of clarity in the Chinese exchange rate policy has become the uncertainty causing the current RMB depreciation.