Confronting criticisms in Sino-African ties

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, May 18, 2012

E-mail China Daily, May 18, 2012

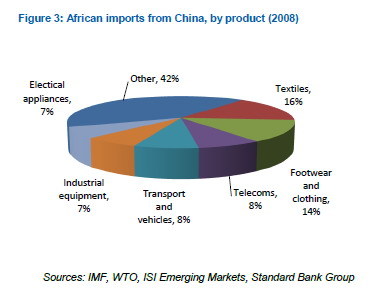

Low-cost consumer products flowing into Africa from China's coastal factories have grown rapidly in recent years. According to Trevor Manuel (2004), China's manufacturing expansion in an environment of low wages is a challenge for a host of African industries; Africa should find ways and means to engage with that reality. Electrical equipment; and nuclear reactors, boilers and machinery each account for 17% of total African imports from China. Vehicles account for 8.5% of Africa's imports from China. In fact, China provides Africa with 10.2% of its vehicle imports. Both cotton and articles of iron and steel amount to above 6% of Africa's total imports from China, respectively. In fact, 10% of Africa's cotton imports come from China. Similarly, a large proportion of artificial filament (10%), ceramic product (9%) and glassware (5%) that is imported by Africa originates from China.

The important challenge facing the continent is not unique to Africa and does not reflect an Africa-specific deficiency. It is important to realise that the composition of Africa's imports from China is consistent with other emerging markets. Consider that, in 2008, intra-BRIC trade amounted to around USD190 bn. China's individual trade with Brazil, India and Russia exceeded USD50 bn, meaning that three-quarters of intra-BRIC trade included China as a counterparty.

China's imports from India amounted to USD20 bn and were dominated by ores, slag and ash; organic chemicals; pearls; iron & steel. China's exports amounted to USD31.5 bn and comprised electrical equipment; machinery; fertilisers and iron & steel.

China's imports from Brazil amounted to USD30 bn and were, like the case of India and Africa, made up of resources, such as ores, slag and ash; mineral fuels; oil seeds, pulp; iron & steel; copper and tobacco. China's exports to Brazil amounted to USD20 bn in 2008, comprising mostly electrical equipment and machinery.

China's imports from Russia breached USD23 bn in 2008, with mineral fuels, wood; iron & steel; nickel; fish; and ores accounting for the lion's share. Meanwhile, China's exports to Russia amounted to USD34 bn and machinery; electrical equipment; footwear; vehicles; and plastics made up the largest share.

Addressing Africa's structural trade imbalance is therefore as much a concern of Africa's ties with China as it is of Africa's relations with all of its traditional commercial partners. For its part, China has constructively attempted to diversify its imports from Africa. Having extended zero-tariff treatment to 440 products in 2006, China committed to open up its market to African products further at the fourth FOCAC meeting in Egypt, phasing in zero-tariff treatment to 95% of the products from the African least developed countries (LDC) having diplomatic relations with China, starting with 60% of the products by the end of 2010. For the most part, few African governments have taken note of the 440 products previously given preferential access to Chinese markets since 2006.4

China offers opportunities for Africa's constructive engagement. China's internal demand is set to grow rapidly over the next decade, from USD1.5 tr in 2009 to around USD5 tr by 2020. Given that China and Africa's economic destinies are increasingly intertwined, any seismic shift in the Chinese economy will have a tremendous bearing on broader Sino-African ties. Despite pessimistic projections to the contrary, African countries have clear opportunities to participate in the opportunities provided by the awakening of China's consumer power, allowing a crucial impetus for the continent to embed itself more meaningfully into global supply chains.